The 618 battlegrounds

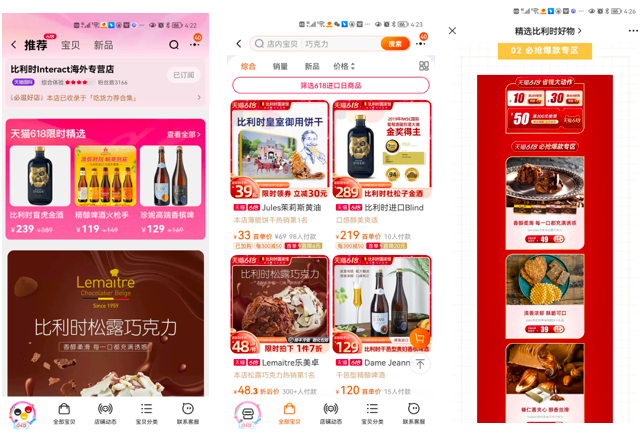

15/6/2022Ever heard of 618? Most people in western countries have heard of ‘Double 11’, the notorious online shopping festival on the 11th of November, created by Alibaba in 2009 and also known as ‘Singles Day’. 618 is the second largest shopping festival in China. It was launched by Jingdong (also known as JD.com) in 2010 to celebrate its anniversary. Initially a one-day event held on 18 June (hence the abbreviation ‘618’), soon it developed into a month-long festival, starting from mid-May and ending on 18 June.

Although still holding the largest market share, Alibaba, JD, and Pinduoduo are recording decelerated growth as they face macroeconomic headwinds, regulatory challenges, pandemic control measures and growing competition from other platforms and apps.

This phenomenon can also be observed during the 618-festival period. All of China’s e-commerce companies are increasingly competing with an ambitious group of short-video platforms and grocery delivery apps looking to grab a piece of the pie.

New rivals like short video platforms such as Douyin and Kuaishou offer inspiring interactive and social content at a time when e-commerce companies are struggling with the increasingly diverse demands of users. While short video apps have large user bases with extended user retention, they have relatively underdeveloped e-commerce ecosystems.

To make up for this, these apps have taken different approaches to expand their e-commerce businesses. In order to convert awareness into purchases, some apps integrate online shopping into their platforms. Other apps continue to expand sales conversions but through external links to other platforms.

It is clear that brands, both Chinese and foreign, need to have a universal strategy, integrating social media, online video, livestreaming and e-commerce, providing a premier customer engagement experience in order to result in successful sales. Also, due to the fact China’s mobile internet population is reaching its ceiling, there are fewer first-time online users to acquire, all players are forced to go after the existing internet users.

The entire MyChinaWeb team in Europe and China is available to help you with your online marketing strategy and implementation in China. We combine local experience with a global outline. Don’t hesitate to contact us if you need any help.